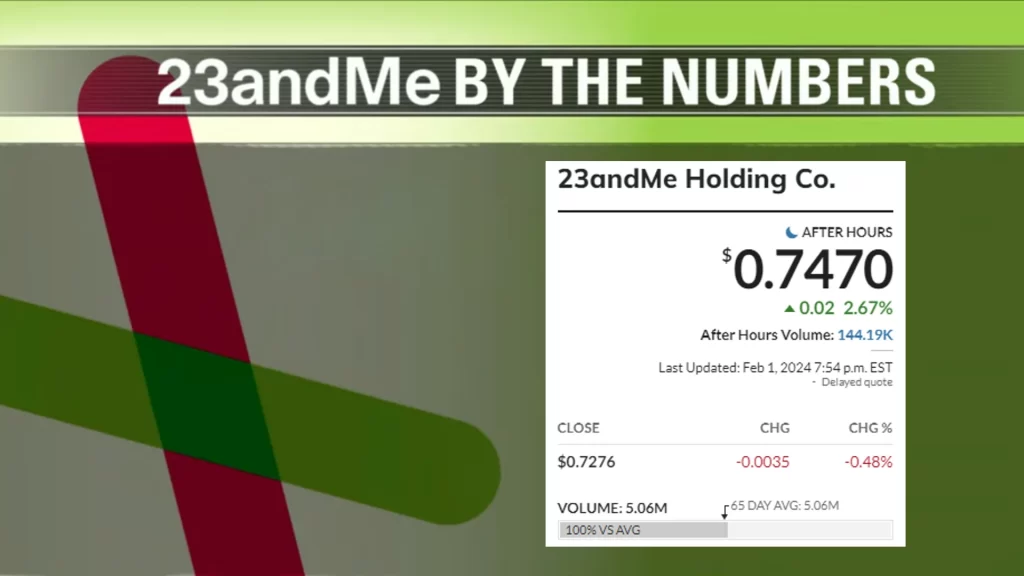

In recent months, 23andMe, the once-celebrated darling of the genetic testing business, has seen an abrupt decline. Investors are cautious, delisting is imminent, and 23andMe stock price has crashed.

What happened?

23andMe burst onto the scene with the promise of democratizing personal genetics. Their initial success was undeniable, fueled by public curiosity and perceived potential for life-changing health insights.

23AndMe is basically dead pic.twitter.com/Tn3JPJnXxa

— Daniel Feldman (@d_feldman) January 31, 2024

However, reality proved harsher. Many customers found the results underwhelming, lacking actionable information or concrete health benefits. The “one-and-done” nature of the test further limited its appeal.

23andme is in deep trouble, struggling to make a profit, 5 years after being insanely hyped.

— Gary Marcus (@GaryMarcus) February 1, 2024

Financial Woes and Missed Targets

This lack of sustained engagement translated into financial woes. Revenue stagnated, losses mounted, and the subscriber base fell short of expectations.

Limited Repeat Value

- Many customers feel a one-time test is sufficient, with few reporting life-changing insights.

Subscription

- According to Business Insider, 23andMe only reached 640,000 subscribers by March 2023, less than half their projected target. Pivoting to subscriptions hasn’t yielded the desired growth.

Data Breach

- A data breach of nearly 7 million customers, discovered five months later, eroded trust and raised privacy concerns.

The company scrambled to adapt, introducing subscriptions and expanding healthcare services, but these efforts seem to have fallen flat.

DNA testing company 23andMe struggling to profit. After scientists saying DNA companies are entertainment and shouldn’t be taken serious I don’t find this too surprising. pic.twitter.com/zR8U9EFBaJ

— HERITAGE American (@privatenotfake) February 2, 2024

23andMe’s struggles go beyond typical growing pains. Data breaches and privacy concerns eroded trust, while the scientific validity of some health interpretations faced scrutiny. Additionally, the broader economic climate with rising interest rates further hampered their efforts.

What’s next for 23andMe?

Genetic testing in the future can learn a lot from 23andMe. Businesses must provide clients with real value and go beyond the first “wow factor”. This may include putting privacy and transparency first, combining genetic data with other health information, and offering useful insights.

People if we let 23andme go under as a company what do you think is going to happen to all their data?? #23andme #DNA #DNAtest

— DaddyRizz (@peacemaker4G) February 2, 2024

23andMe’s future remains uncertain. Can they regain investor confidence and overcome their financial hurdles? Or will they become a cautionary tale in the annals of genetic testing? Only time will tell.

Chart is from new @WSJ report on @23andme. Reporting suggests the company has been mismanaged for more than a decade, failing at drug discovery, never making a profit and overpaying CEO tens of millions of dollars.

(And: 2023 data hack)

Trend does not look good. pic.twitter.com/9aIJrMvsKA

— EasyGenie Genealogy Charts (@easygenie) February 1, 2024

I saw a headline saying 23AndMe has gone from $6 billion to almost $0 and I thought it was an exaggeration but no it’s true. $ME is down -93% since IPO and faces delisting from Nasdaq.

Collecting DNA to provide ancestry information turns out to have been a dangerous fad. pic.twitter.com/isjDlLc4no

— Dare Obasanjo🐀 (@Carnage4Life) February 1, 2024